The Comptroller and Auditor General (CAG), the country’s independent oversight institution, known as the Supreme Audit Institution (SAI) of Bangladesh, is entrusted to promote good governance and accountability as enshrined by the Constitution. The CAG of Bangladesh discharges his statutory responsibilities by the officials of Audit and Accounts Department. The historical chronology of this department during the British and Pakistan period played an important role in aligning it with today's position.

There were three Presidencies namely Bengal, Bombay and Madras under the administrative control of the East India Company. The Presidencies were independent of one another but subordinate to the board of directors in England. They maintained separate accounts which were to be submitted to the Board of Directors. In accordance with the Charter Act of 1813 and 1833, the Company was divested of its commercial character and it became pure administrative body holding the territories of India on behalf of King of England.

Gradually, the country was divided into districts for administrative purpose with a collector at the head. The collector of each district was responsible for all government receipts and expenditure and had to account for all such transactions. The accounts were kept on commercial basis during those days and each department had separate profit & loss accounts. The accounts were not published regularly and if any audit was carried out on those accounts, it was meant for an internal check.

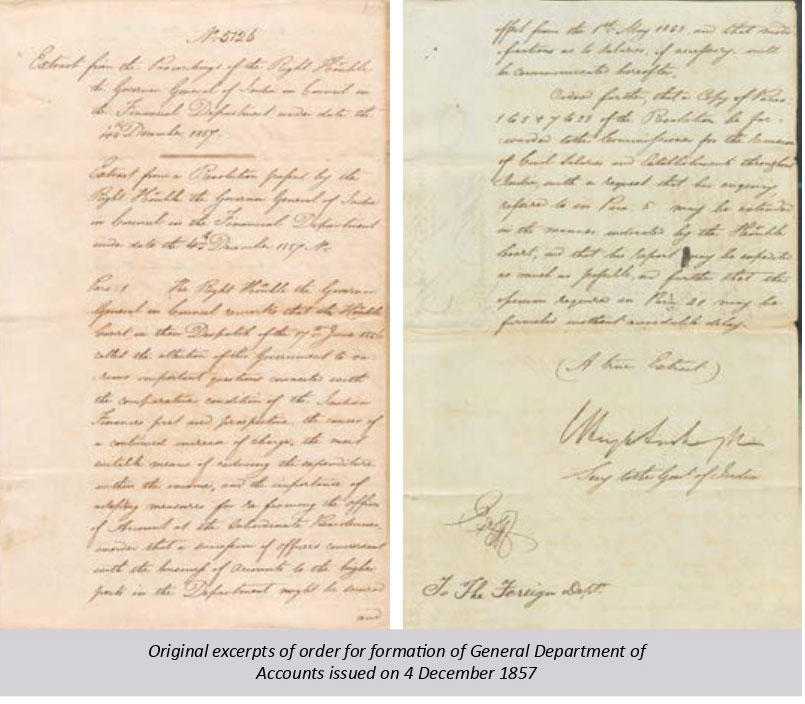

Just prior to the year of Mutiny in 1857, Lord Canning’s Government established a General Department of Accounts under the Government of India with the sanction of the Court of Directors and Board of Control in substitution for the system of separate independent Accounts Offices for each Presidency.

The department started its journey on 04 December 1857 when the Court of Directors issued an order for the establishment of a General Department of Accounts including offices of Audit, Pay and Accounts in several Presidencies along with Punjab under the Government of India. The nomination of the officers in the aforesaid offices was decided by the Governor General in Council.

The Audit Board in India was constituted in 1860 consisting of two members; Auditor General of India, hitherto the Accountant General to the Government of India and Chief of the Military Finance Department who was a controller of Military Finance at each presidency and Examiners of Military Accounts. However, the Accountant General to the Government of India was re-designated by the Auditor General in November, 1860 and the local accountants were placed under Auditor General for preliminary detailed audit of the local accounts. Sir Edmund Drummond was appointed as the first Auditor General on 16 November 1860 by an executive order.

The system of Annual Budget of Imperial Income and Expenditure for sanction by the Government of India was adopted partially in 1860-61 and wholly from 1861-62. This system laid the foundation for imperial audit. The department was reorganized again in 1862. The Financial Secretary became the head of the Financial Department which included the department of audit and accounts. The Auditor and Accountant General to the Government of India became head of those departments.

The Government of India thereupon decided to abolish military finance department and assign the accounting responsibilities to an Accounts Branch formed in Military Department. The officer in charge of the head office of the Military Accounts was designated as “Accountant General” to the military department. In discharge of his duties, he would act in subordination to the Military department. He was, therefore, not associated with Auditor and Accountant General to the Government of India as a member of the Board of Audit. The Audit Board in India was abolished in 1865. The designation of Auditor General of India and Accountant General to the Government of India was re-designated as “Comptroller General of Accounts” in 1866.

The scope of this department was further enhanced in 1881 when the Controllers of Military Accounts, Examiners of Public Works Accounts and Comptroller to the Post Office were opened to the inspection of the Comptroller General of Accounts and his inspecting officers. In pursuance of Government of India, Finance Department Resolution No. 792, dated the 6th May, 1884 Governor General in Council formally appointed the Comptroller General and re-designated as Comptroller and Auditor General (CAG). It was also directed that each Accountant General including the Military and Public Works Accountant General, and each head of separate Audit Department, should prepare and forward to Comptroller and Auditor General each year an Appropriation Audit Report of the province or Department of which he compiled the accounts.

In addition to the inspection of accounts and offices concerned; the CAG was empowered to make a test audit of accounts of any office as he considered necessary. The auditing and inspecting officer was entitled to enter any branch of the office, to call for any documents, and to ask for any information, he may require for the purpose of his audit or inspection. It would be the duty of the heads of all department to provide such information and to afford every reasonable facility for making a test-audit.

Montagu-Chelmsford Reforms (1919) envisaged an ‘Independent’ Auditor General on a statutory basis. The Government of India Act 1919 was a landmark in the history of the Audit Department as the Auditor General was recognized statutorily and his independence and status increased several folds. His title was changed to “Auditor General in India”. Auditor General was appointed by the Secretary of State in Council and his conditions of service were determined by the rules made by the Secretary of State in Council.

Section 39(1) of Government of India Act, 1919 (Later Section 39 was inserted as new Section 96D in the Second Schedule) delineated that –

❝An Auditor General in India shall be appointed by the Secretary of State in Council, and shall hold office during His Majesty’s pleasure. The Secretary of State in Council shall, by rules, make provision for his pay, powers, duties and conditions of employments or for the discharge of his duties in the case of a temporary vacancy or absence from duty❞.

Through Government of India Act,1919 a bicameral Legislature was established at the Centre. The Indian Legislature consisted of the Governor-General and the two Houses – the Council of State and the Legislative Assembly. Assembly was inaugurated on 9th February 1921 and the Public Accounts Committee (PAC) was also constituted in the Indian Parliament System.

The Appropriation Accounts and Audit Report for the year 1921-22 were the first to be examined by the PAC. The Audit Reports placed before PAC by Auditor General were grouped in two sets; Audit Reports and Appropriation Reports. Each set consisted of a number of reports by three Accountants General (Central Revenues, Railways and Postal & Telegraph) who solely deal with the revenue and expenditure of the Government of India. The Auditor General’s Rules was first made by the Secretary of State in Council on 4th January, 1921 and laid down the conditions of employment of the Auditor General, his duties and power as regards audit and accounts and also his administrative power. These rules were superseded by Auditor General’s Rules, 1926 made by the Secretary of State in Council on 13th April 1926, which came into force from 4th January, 1921.

The Appropriation Accounts and Audit Report for the year 1921-22 were the first to be examined by the PAC. The Audit Reports placed before PAC by Auditor General were grouped in two sets; Audit Reports and Appropriation Reports. Each set consisted of a number of reports by three Accountants General (Central Revenues, Railways and Postal & Telegraph) who solely deal with the revenue and expenditure of the Government of India. The Auditor General’s Rules was first made by the Secretary of State in Council on 4th January, 1921 and laid down the conditions of employment of the Auditor General, his duties and power as regards audit and accounts and also his administrative power. These rules were superseded by Auditor General’s Rules, 1926 made by the Secretary of State in Council on 13th April 1926, which came into force from 4th January, 1921.

Auditor General was relieved of keeping railway accounts in 1925. As per the resolution passed by assembly, Auditor General was responsible for Audit alone. It was experimentally introduced in the East Indian Railway from 1st December 1925 which got permanent shape from 1st April 1929 and the Secretary of State in Council made an order regarding this. The Accountant General, Railways, ceased to exist as such with effect from the 1st April 1929. The audit side of the work was taken over by the Director of Railway Audit.

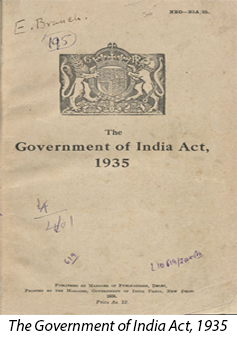

The Government of India Act, 1935 (section 166 to 171) further raised the status of Auditor General. The appointment of the Auditor General would be made by His Majesty and he would be removed from office “in the like manner and on the like grounds as a judge of the Federal Court”. Neither the salary of an Auditor-General nor his rights in respect of leave of absence, pension or age of retirement could be varied to his disadvantage after his appointment and the salary, allowances and pension payable in respect of an Auditor General would be charged on the revenue of the Federation. The provisions of Auditor General Rules 1926 that the Auditor General on vacating office could not hold any other post under the crown in India were also incorporated under section 166(2) of the Government of India Act 1935. The title of the Auditor General in India was changed as Auditor General of India. Then, Government of India (Audit and Accounts) Order, 1936 was issued. Rules were made by His Majesty in council on the 18 December 1936 laying down the conditions of service of the Auditor General and his duties and powers in relation to audit and accounts. The Auditor General was given threefold responsibilities; (i) keeping of the accounts (ii) prescribing the forms and manner of government accounts, and (iii) conducting the audit of all expenditures.

The Government of India Act, 1935 (section 166 to 171) further raised the status of Auditor General. The appointment of the Auditor General would be made by His Majesty and he would be removed from office “in the like manner and on the like grounds as a judge of the Federal Court”. Neither the salary of an Auditor-General nor his rights in respect of leave of absence, pension or age of retirement could be varied to his disadvantage after his appointment and the salary, allowances and pension payable in respect of an Auditor General would be charged on the revenue of the Federation. The provisions of Auditor General Rules 1926 that the Auditor General on vacating office could not hold any other post under the crown in India were also incorporated under section 166(2) of the Government of India Act 1935. The title of the Auditor General in India was changed as Auditor General of India. Then, Government of India (Audit and Accounts) Order, 1936 was issued. Rules were made by His Majesty in council on the 18 December 1936 laying down the conditions of service of the Auditor General and his duties and powers in relation to audit and accounts. The Auditor General was given threefold responsibilities; (i) keeping of the accounts (ii) prescribing the forms and manner of government accounts, and (iii) conducting the audit of all expenditures.

Four categories of offices existed within the Pakistan Audit & Accounts Department; Civil, Posts & Telegraphs (P&T), the Defence Services, and Railways. The Civil, and P&T audit offices were both Audit and Accounts offices while the Defence Services and Railway audit offices dealt only with the audit of the accounts that were maintained by accounts offices not under the control of the Auditor General. The office of the Chief Auditor, High Commission for Pakistan in United Kingdom, dealt with the audit of the accounts maintained in the Pakistan High Commission in the UK. It is worth mentioning that Syed Yaqub Hussain Shah was appointed the first Auditor General of Pakistan.

The Auditor General of Pakistan was appointed under section 166 (1) of the Government of India Act, 1935. His conditions of service were regulated under section 166 (2), his power and duties were determined under section 166 (3) and 168 of this act and the Government of India (Audit and Accounts) Order, 1936. Later, Pakistan (Audit and Accounts) Order, 1952 came into force from 15th August, 1947.

The statutory provisions relating to duties and powers of the Auditor General in the Pakistan (Audit and Accounts) Order, 1952 i.e. keeping of accounts, prescribing the forms and manners of government accounts, and conducting the audit remained same as before 1947.

of the Auditor General in the Pakistan (Audit and Accounts) Order, 1952 i.e. keeping of accounts, prescribing the forms and manners of government accounts, and conducting the audit remained same as before 1947.

The first constitution of Pakistan was promulgated in 1956. Accordingly, the Comptroller and Auditor General of Pakistan was appointed under article 120 (1). His conditions of service were regulated under article 120 (2) and his power and duties were determined under articles 122, 123 and Pakistan (Audit and Accounts) Order, 1952. The Constitution of Pakistan, 1956 was abrogated in 1958.

The Constitution of Pakistan, 1962 (Article 191 to 198) kept similar arrangements for the Comptroller and Auditor General as regards audit and accounts. In the period between 1958 to 1962, the CAG of Pakistan was appointed under article 6 of Laws (Continuance in force) Order, 1958. But his condition of services, duties & power were determined under the Pakistan (Audit and Accounts) Order, 1952.

The Constitution of Pakistan, 1962 (Article 191 to 198) kept similar arrangements for the Comptroller and Auditor General as regards audit and accounts. In the period between 1958 to 1962, the CAG of Pakistan was appointed under article 6 of Laws (Continuance in force) Order, 1958. But his condition of services, duties & power were determined under the Pakistan (Audit and Accounts) Order, 1952.

The Audit of Commercial Accounts of Provincial concerns was conducted by the Outside Audit Branches of the offices of the Provincial Accountant General and Comptrollers. The audit of commercial accounts of the Central Government concerns on the civil side was carried out on behalf of the Accountant General, Pakistan Revenue, by Provincial Accountant General or Comptroller within whose territorial jurisdiction the particular concern is situated, or directly by the Accountant General, Pakistan, Revenue. The audit of commercial accounts of the Central Government concerns on the Defence side was carried out by the Director of Audit, Defence Services.

The Military Accountant General (MAG) was the head of Military Accounts Department, responsible for keeping of the accounts of the Defence Services. There were five Controller of Military Accounts (CMA) under MAG; CMA Lahore, CMA Bahawalpur, CMA Karachi, CMA Rawalpindi and CMA Dacca. Each Controller acted as the financial advisor to the Commander in his audit area. The Controller of Military Accounts (CMA) Dhaka under the jurisdiction of Military Accountant General (MAG), prepared defence accounts of East Pakistan. The office of the Director, Defence Services under CAG was responsible for auditing the Accounts of the Defence Services of Pakistan not for keeping of accounts.

The accounts of the transaction of Railway Department were under the charge of the Financial Advisor, Communications. The Financial Advisor had two officers under him, each designated as Financial Advisor and Chief Accounts Officer (FA&CAO) at Chittagong and Lahore, for compiling the accounts of the two Railways and rendering advice to the Railway administration in financial matters. The Railway audit offices conducted audit only and had no responsibility for the keeping of accounts. Chief Auditor, East Bengal Railway with headquarters at Chittagong and Chief Auditor, North-Western Railway with headquarters at Lahore were the two officers under Director, Railway Audit for conducting audit within their respective zone.

The Comptroller and Auditor General (CAG) of Bangladesh was first statutorily recognized on 28th February, 1972 by a President’s Order (P.O. no. 15 of 1972) who would be appointed by the President. The Constitution of the People’s Republic of Bangladesh became effective on 16th December 1972. The Comptroller and Auditor General of Bangladesh is recognized asa constitutional body and his conditions of service and the scope of his functions have been clearly defined in Part-VIII of the constitution (Article 127 to Article 132). The first CAG of Bangladesh, Mr. Fazle Kader Muhammad Abdul Baqui assumed his office on 11th May 1973.

The Comptroller and Auditor General (CAG) of Bangladesh was first statutorily recognized on 28th February, 1972 by a President’s Order (P.O. no. 15 of 1972) who would be appointed by the President. The Constitution of the People’s Republic of Bangladesh became effective on 16th December 1972. The Comptroller and Auditor General of Bangladesh is recognized asa constitutional body and his conditions of service and the scope of his functions have been clearly defined in Part-VIII of the constitution (Article 127 to Article 132). The first CAG of Bangladesh, Mr. Fazle Kader Muhammad Abdul Baqui assumed his office on 11th May 1973.

The absolute power in relation to audit, given in Article 128(1) to the CAG of Bangladesh,  is unique compared to constitutional provisions of other SAIs’. Article 128(1) delineates:

is unique compared to constitutional provisions of other SAIs’. Article 128(1) delineates:

❝The public accounts of the Republic and of all courts of law and all authorities and officers of the Government shall be audited and reported on by the Auditor General and for that purpose he or any person authorized by him in that behalf shall have access to all records, books, vouchers, documents, cash, stamps, securities, stores or other government property in the possession of any person in the service of the Republic❞.

In an addition, Appellate Division of Bangladesh in its judgment (dated 04-01-2022) on Civil Petition for Leave to Appeal No.2365 of 2020 (arising from the judgment given by High Court Division on W.P. No. 5151 of 2015) reinforced the notion that CAG has the authority to audit assessment of tax pursuant to the constitutional mandate and relevant statutory provisions. In the same judgment, the apex court further opined that wherever income and expenditure of public money is involved, the CAG has power and authority to conduct audit to ascertain the propriety, legality and validity of it.

After independence, Accountant General (East Pakistan) was renamed as Accountant General (Civil). Later, Deputy Accountant General headed Posts, Telegraphs and Telephones Audit Offices in Dacca was upgraded to AG (PT&T) and the office of Deputy Director of audit and accounts (Works & WAPDA) was upgraded to AG (Works & WAPDA). The office of Additional Accountant General (Foreign Affairs), established on May 1973, dealt with accounts of Bangladesh Embassies and High Commissions abroad. It is worth mentioning that these AG offices were responsible for both audit and keeping of accounts. Treasury and Sub-treasury, not under control of Accountant General, were responsible for keeping of initial accounts as standard system with some variations and exceptions. In 1965, the first District Accounts Office (DAO) was established in Chittagong under the control of AG East Pakistan. Later, the DAO offices were established in Sylhet, Comilla and Noakhali districts in 1966, 1968 and 1970 respectively. Up to 1983, there were only four District Accounts Offices (DAO) out of 21 districts.

The Comptroller and Auditor General (Additional Functions) Ordinance, 1973 was promulgated by the President to empower the CAG of Bangladesh with some additional functions; i.e., keeping of Government accounts, audit of accounts of Statutory Public Authorities (SPA), Local Authority and rule-making power. Pakistan (Audit and Accounts) Order, 1952 and the Comptroller and Auditor General (Additional Functions) Ordinance, 1973 were repealed by the Comptroller and Auditor-General (Additional Functions) Act, 1974. The remuneration and privileges of the CAG of Bangladesh was determined by the Comptroller and Auditor General (Remuneration and Privileges) Ordinance 1976 which was repealed by The Comptroller and Auditor-General (Remuneration and Privileges) Act, 1998.

On September, 1974 Local and Revenue Audit Directorate was established, abolishing OAD (Outside Audit department) and LAD (Local Audit Department) section of AG (Civil). After independence, DAG headed office of Commercial Audit Directorate continued its activities and the office of Director General, Commercial Audit was established on 2nd October, 1974. The directorate of Mission and UN Audit (MUNA) was established in 1978 to conduct audit in missions outside Bangladesh as well as UN audit. MUNA was transformed to the office of the Directorate of Mission Audit when Bangladesh ceased to be a member of the UN Board of Auditors in 1984. Office of the Director, Foreign Aided Projects Audit (FAPAD) was established in 1982 to audit various foreign aided projects in Bangladesh.

The Comptroller and Auditor-General (Additional Functions) Act, 1974 was further amended in 1983 to make other persons responsible for keeping Public Accounts. By an office memorandum of Finance Division in 1985, the office of the Controller General of Accounts (CGA) was established and Comptroller and Auditor General is no longer responsible for keeping of Public Accounts. Hence, the offices of the Accountant General (Civil), Accountant General (Works and WAPDA), Accountant General (Post, Telegraph and Telephone) and Additional Accountant General (Foreign Affairs) were restructured and transformed into 20 Chief Accounts Offices for different ministries/divisions and 3 Audit Directorates. Each accounts office was called office of the Chief Accounts Officer (CAO). The auditing function of Accountant General (Civil), Accountant General (W&W), Accountant General (P,T&T) and Additional Accountant General (Foreign Affairs) had been taken over by the offices of Director of Audit (Civil), Director of Audit (Works), Director of Audit (P,T&T) and Mission Audit Directorate respectively. Similarly, the accounting functions of AG (Civil), AG (P,T &T), AG (W&W) and Additional AG (Foreign Affairs) had been distributed ministry/division wise, among 20 newly formed chief accounts offices.

Controller General of Accounts (CGA) had been given responsibility of preparing Finance Accounts and Appropriation Accounts (Civil). Within the new arrangements, CGA would receive accounts from Chief Accounts Offices as well as the Regional Accounts Offices (RAO), District Accounts Offices (DAO) and Upazila Accounts Offices (UAO). District treasuries under Collector were transformed to District Accounts Offices under administrative and functional control of CGA. Similarly, Sub-treasuries were transformed into Upazila Accounts Offices. During 1982-1985, 43 subdivisions were converted into districts and more than 400 upazilas were established as a part of administrative reform throughout Bangladesh. Thus, 20 Regional Accounts Offices, 64 District Accounts Offices and 400 Upazila Accounts Offices were established under CGA by Finance Division memorandum in 1985. This is how, age-old treasury system of keeping initial accounts had been replaced by Pay and Accounts offices (RAO, DAO, UAO) under CGA.

Controller General of Accounts (CGA) had been given responsibility of preparing Finance Accounts and Appropriation Accounts (Civil). Within the new arrangements, CGA would receive accounts from Chief Accounts Offices as well as the Regional Accounts Offices (RAO), District Accounts Offices (DAO) and Upazila Accounts Offices (UAO). District treasuries under Collector were transformed to District Accounts Offices under administrative and functional control of CGA. Similarly, Sub-treasuries were transformed into Upazila Accounts Offices. During 1982-1985, 43 subdivisions were converted into districts and more than 400 upazilas were established as a part of administrative reform throughout Bangladesh. Thus, 20 Regional Accounts Offices, 64 District Accounts Offices and 400 Upazila Accounts Offices were established under CGA by Finance Division memorandum in 1985. This is how, age-old treasury system of keeping initial accounts had been replaced by Pay and Accounts offices (RAO, DAO, UAO) under CGA.

In 1974, office of the Military Accountant General (MAG) was established. A branch of the MAG office conducted post-audit of Defence Accounts and provided Audit Reports to Comptroller & Auditor General through MAG. CMA, Dhaka and CMA, Bogra were established under MAG. Moreover, there were Controller of Naval Accounts (CNS) for Bangladesh Navy, Controller of Air Force Accounts (CAFA) for Bangladesh Air Force and Controller of Factory Accounts (COFA) for Bangladesh Ordnance Factory. In December 1982, Defence Finance Department (DFD) was established following

a Finance Division order “Revised System of Financial Management for the Defence Forces, 1982”. The Office of the Military Accountant General (MAG) was renamed as the Office of the Controller General Defence Finance (CGDF). Thus, CGDF became head of Defence Finance Department. There are five Senior Finance Controller (SFC) offices along with Finance Controller (FC) offices, Area Finance Controller (AFC) offices and Field Pay Offices (FPO) under the control of CGDF office. These offices are responsible for various payments of Defence Forces and preparing respective accounts within their jurisdiction. The office of the Controller General Defence Finance (CGDF) prepares Appropriation Accounts (Defence). Following these changes, office of the Director, Defence Audit was established in 1983.

a Finance Division order “Revised System of Financial Management for the Defence Forces, 1982”. The Office of the Military Accountant General (MAG) was renamed as the Office of the Controller General Defence Finance (CGDF). Thus, CGDF became head of Defence Finance Department. There are five Senior Finance Controller (SFC) offices along with Finance Controller (FC) offices, Area Finance Controller (AFC) offices and Field Pay Offices (FPO) under the control of CGDF office. These offices are responsible for various payments of Defence Forces and preparing respective accounts within their jurisdiction. The office of the Controller General Defence Finance (CGDF) prepares Appropriation Accounts (Defence). Following these changes, office of the Director, Defence Audit was established in 1983.

After independence, Pakistan Eastern Railway was renamed as Bangladesh Railway and office of the Financial Advisor & Chief Accounts Officer (FA&CAO) was responsible for preparing the accounts of Bangladesh Railway. The designation of Financial Advisor & Chief Accounts Officer (FA&CAO) was changed as Accountant General for a short span of time, which was renamed again as FA&CAO. On 3rd June 1982, the Railway Board was abolished and its function was placed under the control of Railway Division of Ministry of Communications. The Railway Division was abolished in 1995 and Bangladesh Railway Authority (BRA) was established.

After independence, Pakistan Eastern Railway was renamed as Bangladesh Railway and office of the Financial Advisor & Chief Accounts Officer (FA&CAO) was responsible for preparing the accounts of Bangladesh Railway. The designation of Financial Advisor & Chief Accounts Officer (FA&CAO) was changed as Accountant General for a short span of time, which was renamed again as FA&CAO. On 3rd June 1982, the Railway Board was abolished and its function was placed under the control of Railway Division of Ministry of Communications. The Railway Division was abolished in 1995 and Bangladesh Railway Authority (BRA) was established.

Then, Additional Director General (Finance), Bangladesh Railway is entrusted with the responsibility of Railway Accounts. There are three FA&CAO offices under ADG(Finance), Railway; FA&CAO/East for East zone of Railway, FA&CAO/West for West zone of Railway and FA&CAO/Project. The offices of Deputy Financial Advisor & Chief Accounts Officer (DFA&CAO) under FA&CAO offices are responsible for payment and accounting of Bangladesh Railway. FA&CAO/East compiles the accounts of two Railway Zones.

The office of the Chief Auditor, Railway Audit at the Central Railway Building (CRB) in Chittagong was responsible for auditing the accounts of the then Pakistan Eastern Railway. This office continued its activities even after the independence of Bangladesh and later renamed as the Directorate of Railway Audit.

The Financial Management Academy (FIMA) was originally established as the Audit and Accounts Training Centre, in 1962, to impart training to non-gazette employees of the different audit offices stationed in Dhaka under the control of the Comptroller and Auditor General (CAG) of the then Pakistan. After independence, the Training Centre was upgraded in 1974 as the Audit and Accounts Training Academy (AATA) to train the newly recruited BCS (Audit and Accounts) Cadre probationary officers along with other trainings and was headed by a Director General under the direct control of the OCAG of Bangladesh. Later, in 1997, considering its potential role in improving the public financial service delivery, the Audit and Accounts Training Academy (AATA) was elevated to the Financial Management Academy (FIMA) as it is known today.

The Financial Management Academy (FIMA) was originally established as the Audit and Accounts Training Centre, in 1962, to impart training to non-gazette employees of the different audit offices stationed in Dhaka under the control of the Comptroller and Auditor General (CAG) of the then Pakistan. After independence, the Training Centre was upgraded in 1974 as the Audit and Accounts Training Academy (AATA) to train the newly recruited BCS (Audit and Accounts) Cadre probationary officers along with other trainings and was headed by a Director General under the direct control of the OCAG of Bangladesh. Later, in 1997, considering its potential role in improving the public financial service delivery, the Audit and Accounts Training Academy (AATA) was elevated to the Financial Management Academy (FIMA) as it is known today.

In 1995, all the offices of the Director of audit were renamed as offices of the Directorates General of Audit.

In pursuance of a memorandum issued by the Finance Division in 2002, 20 Chief Accounts Offices were transformed into 49 through reorganization and 6 Divisional Accounts Offices (DCA) were established abolishing Regional Accounts offices (The number of DCA office is now eight). The offices of the CAOs have given the responsibility for the payment functions of respective Ministry/ Divisions within Dhaka and preparing accounts.

The government's civil accounting functions along with payment for the rest of the country are carried out by the offices of DCAs, DAOs and UAOs under the control of the CGA.

Performance Audit Directorate was established in October 2005 by an office order of Finance Division. Thus, the total number of Audit Directorate under CAG became ten. Further re-organization of Audit and Accounts Department was made in November, 2019 by a Finance Division order. Ten Audit Directorates reorganized into seventeen Audit Directorates and new offices & posts were created and upgraded in Audit and Accounts Department. Chief Accounts Office (CAO) was renamed as Chief Accounts and Finance Office (CAFO) and District Accounts Office (DAO) was renamed as District Accounts and Finance Office (DAFO).

Performance Audit Directorate was established in October 2005 by an office order of Finance Division. Thus, the total number of Audit Directorate under CAG became ten. Further re-organization of Audit and Accounts Department was made in November, 2019 by a Finance Division order. Ten Audit Directorates reorganized into seventeen Audit Directorates and new offices & posts were created and upgraded in Audit and Accounts Department. Chief Accounts Office (CAO) was renamed as Chief Accounts and Finance Office (CAFO) and District Accounts Office (DAO) was renamed as District Accounts and Finance Office (DAFO).

The office of the Comptroller and Auditor General of Bangladesh aligned functional areas of Audit Directorates according to a group of ministry/ divisions. Comptroller and Auditor General of Bangladesh promulgated Government Auditing Standards of Bangladesh (GASB), Code of Ethics (CoE), Quality Control System (QCS) along with Compliance Audit Guidelines and Financial Audit Guidelines in 2021. These standards and guidelines aligned the public sector audit with the latest international standards.

The Office of the Comptroller and Auditor General of Bangladesh named as “Audit Bhaban”